If productive people are the most valuable asset of an organization, data is its most precious boon. Estimates show that 90% of accessible information comes from hundreds of millions of digital data elements from social networks, Internet searches, e-commerce, emails, SMS, GPS and many more. CFOs cannot afford to ignore these massive pools of information growing at a staggering pace. Simply collecting them for reporting purposes is not enough. The true value of data is its role in influencing business decisions in order to help cut costs, enhance operational efficiencies, mitigate risks and improve the bottom line.

If productive people are the most valuable asset of an organization, data is its most precious boon. Estimates show that 90% of accessible information comes from hundreds of millions of digital data elements from social networks, Internet searches, e-commerce, emails, SMS, GPS and many more. CFOs cannot afford to ignore these massive pools of information growing at a staggering pace. Simply collecting them for reporting purposes is not enough. The true value of data is its role in influencing business decisions in order to help cut costs, enhance operational efficiencies, mitigate risks and improve the bottom line.

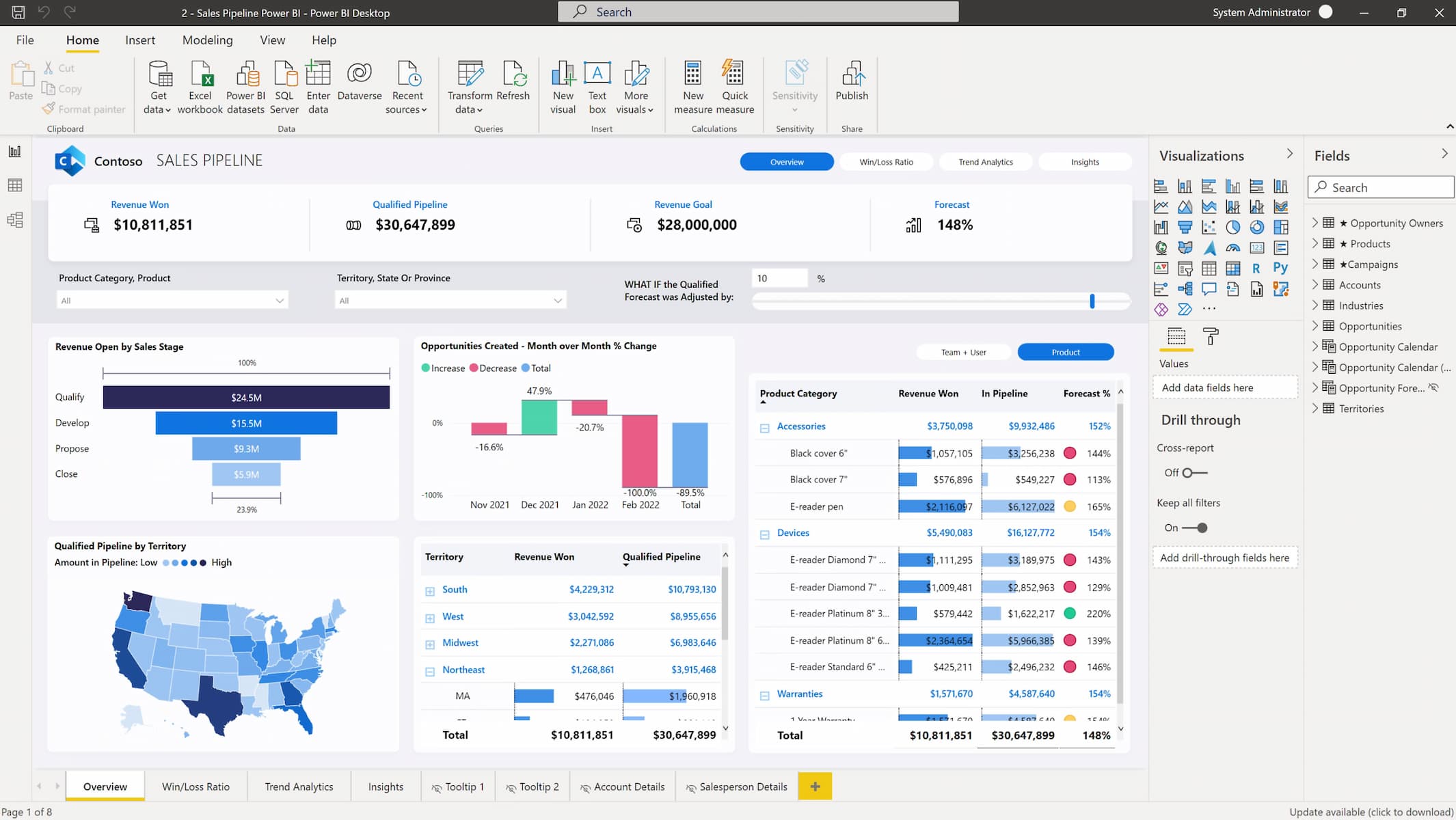

More than ever before, information is becoming a powerful tool of identifying trends and making actionable decisions even from disparate sources. It helps deliver the right information to the right people at the right time through the right platforms, thereby opening windows for new opportunities for the organization. Data is the main ingredient of business intelligence, a decision support tool. That is why data analytics is as important as data management, data migration and other managed data services.

Data and Business Intelligence

The explosion of data in recent years is quite overwhelming with all sectors – manufacturing, retail, telecommunications, healthcare, utilities, law enforcement, education and even government - looking to get their share. With business intelligence, companies can become more responsive to both their customers and competitors and increase revenues in the process. For instance, empowering employees with more product knowledge can increase operating income. Employees who can explain all the features and benefits of their products are likely to be able to convince customers to buy. There are also instances when customers consider ratings and awards on products or companies. Happy employees are likewise an advantage on businesses like hotels and casinos. As the strategic business planner of your company, it pays to train your employees well and aim for ratings and awards to win your target market.

Data and the CFO

As technology continues to transform the business landscape, CFOs need to stay alert and tuned to overwhelming data coming from all directions. Data is a game-changer that requires new ways of doing business to develop sustainable growth and create real value for organizations. It is thus important for CFOs to know their role in managing data and be aware of the following:

- Understanding data – To effectively and efficiently manage data, CFOs need to know what it is made of and where it came from. Gathering, sorting and storing data are likewise vital to determine what is relevant, reliable and useful for more strategic decision making and for turning information into value.

-

Analyzing data – With the confluence of vast structured and unstructured information, CFOs need technology support to be able to truly analyze data. Data analysis can be challenging but making decisions using the outcomes can even be more crucial. While technology tools like OBIEE, Endeca, and Hyperion do help, in the end it is still people who make the decisions.

-

Using relevant and trusted data in making decisions – Thoroughly understood and analyzed data form the basis of CFOs for making critical decisions based on market perceptions, customer sentiments and long-term trends. They are then closer to their business objectives of increasing sales, decreasing costs and filling the company coffers.

With the increasing volume, velocity and variety of data in a digitized environment, a new role for CFOs is emerging. Enormous data may yet transform the business decision process to the next level.

Comments

Comments not added yet!